Proposed US Tax Law Changes

The long-awaited text of a US tax reform bill was released November 2, 2017, by the House Committee on Ways and Means. Following those principles announced previously on several occasions, it adds needed detail to the plan for tax reform. The draft bill is generally not good news for the mobility industry. The broad nature of change contained in the bill, and if signed into law, would affect nearly all taxpayers.

Some of the proposed changes individual taxpayers may see include, among others:

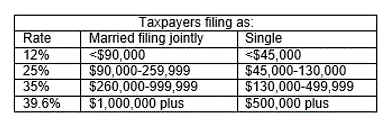

- Reduction and simplification of individual tax rates from seven current tax brackets to four brackets of 12%, 25%, 35% and 39.6%. The income levels for the four brackets are as follows:

- The standard deduction would increase to $24,400 for joint returns, and $12,200 for single filers. The personal exemption deduction would be repealed.

- The mortgage interest deduction is retained, but is proposed to be limited to debt not exceeding $500,000. The current limit is $1,000,000. In addition, the deduction would be limited to the principle residence of the borrower. Second homes would not be eligible.

- The deduction for state and local sales taxes would be repealed, as well as the deduction for state and local income taxes. Property taxes would continue to be deductible, but only up to $10,000.

- The alternative minimum tax would be repealed, as would the estate tax.

- The capital gain home sale exclusion is retained, but would be modified significantly. Under the bill, a homeowner would have to have owned and occupied the home for 5 of the 8 years preceding its sale, as opposed to the current 2-of-5 rule. Moreover, the benefit of the exclusion would phase out for taxpayers whose average Adjusted Gross Income over the prior three years exceeded $250,000. The excludable gain would be reduced by the amount by which AGI exceeded $250,000.

- The moving expense deduction would be repealed, as well as the exclusion for employer-paid moving expenses. Consequently, employers would be faced with additional gross-up expenses.

The bill is subject to considerable change between now and any potential enactment. Moreover, the Senate has drafted its own bill, released on Thursday, November 9. The House and Senate bills are broadly similar in their outlines. Both would lower rates for individuals, while eliminating deductions claimed by many taxpayers.

For example, the House version would collapse the current seven tax brackets into four, while the Senate would retain seven. The House bill would entirely eliminate the estate tax, while the Senate version would retain it while doubling the exemption level. Both versions would retain an adoption tax credit.

The Senate bill would leave the mortgage interest deduction the same as current law, but would eliminate the state and local tax deductions including real estate taxes.

We will continue to monitor the progress of the legislation and will provide an update when additional information becomes available.

Hypothetical Tax Withholding Updates

Updates to hypothetical tax withholding are often made when tax laws change.

For purposes of this discussion, a hypothetical tax calculation refers to a periodic estimate of an assignee's annual stay-at-home tax. The computation is prepared to determine the amount of "tax" to be ratably withheld from an international assignee's wages while on assignment. Many employers will prepare a detailed hypothetical tax calculation when an assignee first goes on assignment and then annually thereafter. Generally, the annual tax equalization is prepared at the end of the year, or when the home country tax return is prepared, to reconcile the assignee's actual stay-at-home tax with the hypothetical tax withheld.

Generally, an assignee's hypothetical tax withholding is adjusted at the beginning of each tax year and whenever salaries change. Given the proposed changes in US tax legislation, most of which may be effective January 1, 2018 if approved as currently prepared, it will very important to update the hypothetical withholding for your assignees as soon as any changes become law.

To learn more about hypothetical withholding, please download our frequently asked questions document.

GTN Solutions – Hypothetical Tax

There are many factors for companies to consider with regard to hypothetical taxes. GTN offers various solutions to assist with incorporating hypothetical tax as a critical component of your mobility policy. We also provide guidance on how to report hypothetical taxes from a financial accounting perspective.

- Our Mobility Tax Policy Services includes customized assistance in developing and implementing tax policies to support your current business and employee needs.

- Our Mobility Tax Accounting Services offers assistance in identifying, understanding, and accounting for the tax costs of your mobile workforce. Hypothetical tax can be a large liability if not accounted for correctly and is an important piece of the tax accrual process.

Contact me at sabadin@gtn.com or at +1.708.887.0275 for more information on how these solutions can help.

The information provided in this newsletter is for general guidance only and should not be utilized in lieu of obtaining professional tax and/or legal advice.

Author: Sajjad Abadin

Sajjad began his career with GTN in 2014 and currently serves as Senior Manager in GTN’s Great Lakes region. He has nearly 15 years of experience in expatriate and foreign national tax preparation and consulting. He oversees multiple companies’ mobility tax programs as well as many independent assignees. Clients rely on Sajjad to expand their understanding of complex mobility tax issues, and they put trust in his ability to coordinate and manage the intricacies of their specific mobility programs. sabadin@gtn.com | +1.708.887.0275

Sajjad began his career with GTN in 2014 and currently serves as Senior Manager in GTN’s Great Lakes region. He has nearly 15 years of experience in expatriate and foreign national tax preparation and consulting. He oversees multiple companies’ mobility tax programs as well as many independent assignees. Clients rely on Sajjad to expand their understanding of complex mobility tax issues, and they put trust in his ability to coordinate and manage the intricacies of their specific mobility programs. sabadin@gtn.com | +1.708.887.0275