Global mobility tax support in 140+ countries

Whether your employees are in one country or across a hundred, GTN provides seamless, compliant mobility tax support delivered through a single coordinated team dedicated to your success.

Consistent quality. Scalable support. Local insight.

Managing a mobile workforce across borders doesn’t need to be complicated. With GTN, you'll have a coordinated approach to global mobility tax. Combining centralized oversight with reliable in-country delivery in more than 140 locations worldwide.

We adapt as your footprint expands, providing:

What Global Coverage Means for You

Coverage across 140+ countries

From assignments in major financial hubs to remote project locations, GTN provides the same high-quality mobility tax services wherever your business takes your employees.

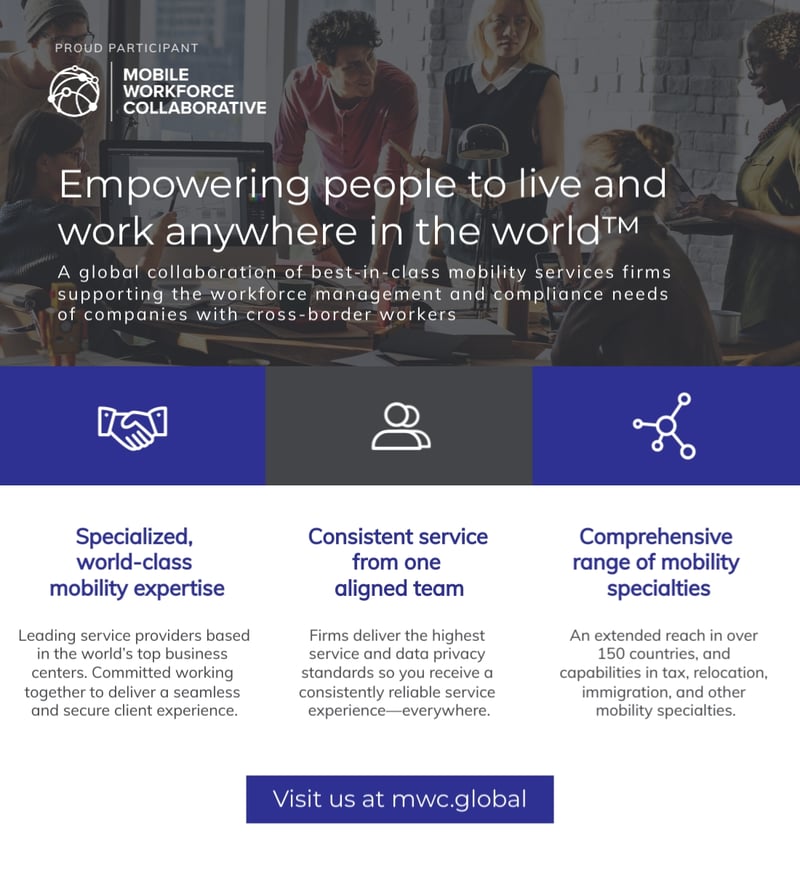

Collaboration through MWC

GTN is a proud Participating Firm of the Mobile Workforce Collaborative (MWC) – a global group of independent mobility tax and advisory firms united by shared service standards and a commitment to exceptional client experience.

Through this collaboration, we expand our reach while maintaining the high-touch service and governance our clients rely on.

Frequently Asked Questions

Here are some common questions we get asked about our global coverage and delivery model.

Still have questions about our global reach or service delivery?

Additional Resources

Building a reliable, scalable global mobility program takes more than just coverage. It requires insight, structure, and accountability. Explore these resources to see how GTN helps organizations like yours achieve consistent results across 140+ countries.