Chinese officials recently announced amendments to the Individual Income Tax (IIT) law, signifying the first major modifications since 2011. The changes are intended to boost economic growth and will affect the taxation of both local employees and mobile employees that are on assignment in China. Full implementation of the changes will occur on January 1, 2019. However, the new tax tables and standard basic monthly deduction went into effect on October 1, 2018. We highlight key changes relating to personal income taxation below:

Residency rules

The definition of a tax resident has been amended. The following provides a summary of the current and upcoming rules:

Current rules

A Chinese resident is defined as a foreign citizen or national who spends 365 days in China during the tax year or who is domiciled in China. An individual is domiciled in China if they habitually reside in China due to their household registration, family, or economic relations.

A tax resident is generally subject to Chinese income tax on worldwide income. Non-domiciled individuals, who reside in China for one full year, but less than five full years (“five year rule”), are subject to tax on income earned for China services and income for non-Chinese services paid by a Chinese employer.

Upcoming rules (from January 1, 2019)

While Chinese domiciled individuals are still considered tax residents, non-domiciled individuals will now be considered tax residents of China if they are physically present in China for more than 183 days in a calendar year (change from 365 day period noted above).

As mentioned, the “five year rule” has historically applied for non-domiciled tax residents. There has not been an official update from the tax authorities on whether this rule will continue to apply, but it seems likely that it will be more difficult for non-domiciled individuals to avoid becoming tax residents. It will be important to monitor developments in this area.

Categories of income and tax rates

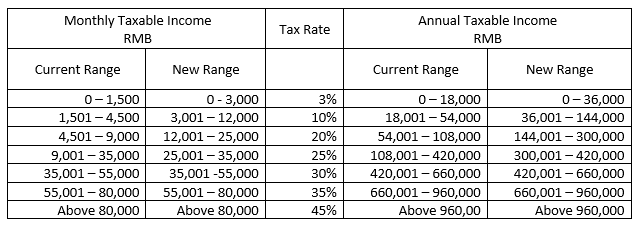

Complicated multiple progressive tax rates were previously enforced for various income categories. The new rules have reduced the number of categories, with income from wages and salaries included under “comprehensive income,” with a rate structure from 3% to 45% (see table below).

Tax tables

A new, more beneficial, rate structure was implemented on October 1, 2018. The tax table for comprehensive income, including income from wages and salaries, is as follows

Standard basic deduction

A standard basic deduction had previously allowed a monthly reduction of Yuan RMB 3,500 from taxable income. A new standard basic deduction of Yuan RMB 5,000 went into effect on October 1, 2018.

Identification numbers

Under the new law, a unique taxpayer identification number will be generated by the tax authorities for each taxpayer. In the past, non-Chinese individuals had used their passport number as their tax identification number. There has not yet been guidance on whether non-Chinese taxpayers will need to apply for a new identification number.

Self-reporting procedures

The new law will require new procedures that are very similar to US tax reporting requirements relating to payroll and income tax filings:

- The new law will require the employer (withholding agent) to provide a year-end statement to the employees reflecting their annual compensation and tax withholding (similar to the US Form W-2). Clarification has not yet been provided if this statement will also need to be provided to the tax authorities.

- Under the new law, income tax will be computed based on annual income, with the monthly calculations representing estimated tax payments.

- Under current tax law, income tax is computed based on monthly income. The new law will allow employee-provided deductions to be considered by the employer in calculating the employee’s monthly tax withholdings (procedure akin to the use of Form W-4 in the US).

- With deductions available to China nationals, there will now be a reconciliation of income and withholding through the filing of an annual income tax return (function similar to Form 1040 filings in the US). Previously, annual filings were rarely required for taxpayer’s without non-employment income.

- Taxpayers who are non-resident (i.e., in China less than 183 days in the calendar year) will continue to compute and pay tax on a monthly basis. An annual income tax return will not be required in these cases.

If you have questions about these changes, contact us at info@gtn.com or +1.888.486.2695, or visit our Mobility Tax Services page to see what assistance we can provide.

The information provided above is for general guidance only and should not be utilized in lieu of obtaining professional tax and/or legal advice.