On December 20, 2017, Congress passed “An Act to provide for reconciliation pursuant to titles III and V of the concurrent resolution on the budget for fiscal year 2018”. The original, much shorter name, was the “Tax Cuts and Jobs Act”, but it had to be disregarded late in the process in order to not violate the Senate’s Byrd Rule. President Trump signed the bill into law on Friday, December 22, 2017.

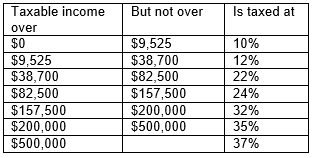

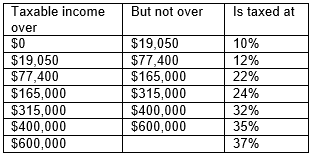

Many of the provisions in the law take effect on January 1, 2018, and will expire on December 31, 2025. One of the biggest changes is in individual tax rates. Tax brackets for single and married taxpayers filing joint returns are shown below:

Single taxpayers

Married taxpayers filing joint returns and surviving spouses

Deductions

The bill increases the standard deduction from $13,000 (2018 amount before the law change) to $24,000 (married) and to $12,000 (single). However, the personal exemption has been suspended. Under pre-Act law, for 2018, a married couple with two children would have been able to claim a total of $29,600 as deductions ($13,000 for standard deduction and $16,600 for exemptions). Under the new tax law, the same couple will have a standard deduction of $24,000.

Another change relates to itemized deductions. Under pre-Act law, individuals could deduct several items as itemized deductions assuming they met certain thresholds. Examples include state and local income taxes, real and personal property taxes, mortgage interest and charitable contributions.

The new law limits the deduction of state and local taxes and real or property taxes. Under the new law, itemized deductions would be limited to $10,000 ($5,000 for married filing separate) for state and local income taxes and real and property taxes combined. Foreign real property taxes will no longer be able to be deducted.

- Planning Opportunity – If you were planning on making a fourth quarter estimated tax payment for the 2017 tax year, normally due in January 2018, it may make sense to make the payment before calendar year end. However, Congress was clear in that they will not allow a deduction for prepaid 2018 state or local income taxes.

Mortgage interest can be taken as an itemized deduction with a few changes. The deduction for mortgage interest is limited to underlying indebtedness of up to $750,000 ($375,000 for married taxpayers filing separately). The previous limitation was $1 million of indebtedness. This new limitation is applied to loans after December 15, 2017. There are some transition rules for contracts entered into between December 15, 2017 and April 1, 2018. In addition, taxpayers are no longer allowed to take a deduction for interest on a home equity loan.

Beginning in 2018, itemized deductions for personal casualty and theft losses are eliminated, except for personal casualty losses incurred in a federally-declared disaster area.

The deduction for certain miscellaneous itemized deductions, if they exceed 2%, of the taxpayer’s adjusted gross income has also been suspended. This includes the deduction for tax return preparation fees.

The good news for itemized deductions is that the so-called “phase out” or limitation on itemized deductions has been suspended beginning in 2018.

Beginning with the 2019 tax year, alimony will no longer be a deduction for the payor nor will it be considered as income to the recipient. This would apply to any divorce or separation agreement executed after December 31, 2018.

Credits

Beginning with calendar 2018, the child tax credit increases from $1,000 to $2,000 per child. In addition, the credit will be reduced for income over $400,000 for married taxpayers filing jointly. The phase out threshold will not be indexed for information. An additional $500 credit may be provided for other qualifying dependents. In order to claim the child tax credit on an income tax return, the child must have a Social Security Number and is issued prior to the due of the income tax return.

Education

The new tax law expands the rules under Section 529. Under the pre-Act law, educational funds under Section 529 could only be used for post-secondary education (e.g. college). Under the new tax rules, starting with 2018, you would be able to take federal-income-tax-free withdrawals of up to $10,000 a year to cover tuition at a public, private, or religious elementary or secondary school.

- Planning Opportunity – Some states allow a deduction for contributions to Section 529 plans. You may want to increase your contribution to a 529 plan in 2017. You would then be able to use it for elementary or secondary school tuition in 2018.

- Planning Opportunity – if you moved in 2017, you may want to make sure all of your expenses are finalized so a deduction can be potentially utilized on your 2017 income tax return.

Moving Expenses and Home Sale

In prior years, moving expenses incurred, after meeting qualifying tests, could either be deducted from a taxpayer’s income tax return or if reimbursed by the employer, excluded entirely. For tax years beginning after December 31, 2017, the deduction/exclusion is suspended except for military moves.

In prior drafts of the bill, the exclusion on the sale of home was changed to increase the ownership and use time limits. Fortunately, this was removed from the final bill. Thus, the existing law remains which means a taxpayer can potentially exclude from federal taxation up to $500,000 (married filer) of gain from a qualified home sale.

Alternative Minimum Tax (AMT)

Alternative minimum tax is a separate tax system from our regular tax system. The intent of the alternative minimum tax system was to prevent a taxpayer with substantial income from avoiding tax by using deductions, exclusions, and credits. Under the new law, the exemption amounts have been increased for married filing joint from $86,200 (2018 law) to $109,400.

As you can see, the recently enacted tax bill will have broad ranging changes and implications. We expect additional details to be forth coming and encourage you to reach out to your tax professional with any questions or concerns.

If you have additional questions, contact us at info@gtn.com or at +1.888.486.2695.

The information provided above is for general guidance only and should not be utilized in lieu of obtaining professional tax and/or legal advice.