.webp?width=920&height=613&name=Depositphotos_426484354_XL-1%20(1).webp)

Equity plan program managers and participants have likely heard of an 83(b) election (“Election to include in Gross Income in Year of Transfer”), but often its application and advantages are misunderstood. Section 83 of the Internal Revenue Code (IRC) governs several tax functions when determining the tax consequences of transfers of restricted property such as equity or stock. These special rules determine whether an employee has income resulting from a transfer of property, when an employee will recognize taxable compensation, and how much taxable compensation will be recognized.

Most equity grants have vesting conditions (restrictions) that cause the transfer of stock to be subject to a substantial risk of forfeiture, depending on the attainment of time-based or performance-based conditions. These conditions are in place to align the employee’s performance to the long-term value of the company. Under IRC Section 83, the timing of taxation of restricted stock is the later of transfer, or when the restrictions have lapsed, i.e., when the stock has vested.

In addition to considering the US tax implications of making an 83(b) election, many mobile employees need to consider the potential for other tax obligations when they are working in multiple locations over the vesting period including:

- Misalignment of timing of taxation

- Misalignment of income sourcing

- Foreign tax credit mismatches

These mismatches can result in an element of double taxation for the employee that cannot be mitigated, eroding the value of the award. Careful attention should be given to mobile employees that have either made an 83(b) election for an outstanding award, or that may be transferred into the US while holding restricted property.

Given the complexity and potential risks, it is critical to have a full understanding of the IRC rules and to establish appropriate processes and procedures. To assist in this undertaking, below we answer common questions and provide insights on best practices.

What is an 83(b) election?

An IRC Sect. 83(b) election is a planning tool that can be utilized by taxpayers who receive property (stock) subject to a substantial risk of forfeiture. It allows the taxpayer to choose to accelerate the timing of taxation (and often the amount of income subject to tax, depending on the value of the property) to the point of grant, rather than the default of taxation at vesting. For tax purposes, this crystallizes the ordinary compensation element that is included in the taxpayer’s Form W-2 compensation (generally, fair market value of the stock at the date of grant, less any amounts actually paid for the stock), and starts the capital gains clock ticking. Any future appreciation from the point of grant will be subject to tax at preferential capital gains rates if the property is held more than one year.

An 83(b) election can be a bit of a gamble and needs to be considered carefully by taxpayers. In the best-case scenario, the stock appreciates over time and the taxpayer has recognized a smaller amount of ordinary income. In a less favorable outcome, the stock price depreciates over the vesting period and the taxpayer will have paid more tax upfront than they would have paid if the default taxation at vesting, without the 83(b) election, was applied. Further, if vesting conditions are not satisfied (for example, if the employee leaves the company prior to vesting), the stock may be forfeited, and the tax paid at grant is a sunk cost. Capital losses are not allowed for any ordinary income inclusions or taxes paid with an 83(b) election. If, however, the taxpayer actually paid an amount for the stock at grant (basis), they could recognize a loss if the stock is sold for less than their basis. Taxpayers must carefully assess whether to make an 83(b) election to minimize the risk of paying more tax than they otherwise would without the election.

Who can make an 83(b) election?

Any taxpayer that receives a transfer of property that is subject to a substantial risk of forfeiture can make an IRC Sect. 83(b) election.

When can an 83(b) election be made?

The timeline to make the election is strictly enforced by the IRS. The election must be filed with the IRS (postmarked) within 30 days from the date of transfer of the restricted property. A copy of the election must also be provided to the employer within 30 days of transfer of the property. This allows the employer to properly include in income the difference between the fair market value on the date of grant less any amounts paid for the stock, and remit the applicable federal, state (if applicable), and FICA withholding.

What types of equity does an 83(b) election commonly apply to?

An 83(b) election applies to any transfer of property that is subject to a substantial risk of forfeiture. Equity grants of restricted stock awards, stock received at the exercise of an option prior to vesting conditions being met (commonly referred to as early exercise provisions), partnership capital interests, and profits interests are all common types of awards where an 83(b) election may be available to a taxpayer.

It is important to remember that non-US equity plans may also qualify for an 83(b) election, even if the election is not necessarily considered by the plan or contemplated by the management of the company. IRC Sect. 83 is relevant to any individual with US tax obligations that receives a transfer of property that is subject to a substantial risk of forfeiture in connection with the performance of services. If that criterion is met, an 83(b) election should be considered for US taxpayers or non-US individuals that might become US taxpayers over the vesting period.

An actual transfer of property must occur before Section 83 applies. Therefore, an 83(b) election cannot be made on stock options, as the option itself is merely the right to purchase stock at a specified price, rather than an actual transfer of property at the point of grant. Similarly, restricted stock units and performance stock units are merely a promise to pay stock (or cash) in the future and the transfer of stock does not happen until vesting conditions have lapsed, therefore the property that is received at vesting is no longer subject to forfeiture. Deferred compensation arrangements of any type where there is no transfer of property that is subject to vesting conditions is simply cash compensation and not a transfer of property.

What are the common mobility considerations associated with making (or not making) an IRC Sect. 83(b) election?

US Outbound

An 83(b) election is entirely a US tax concept and in most cases is irrelevant in other jurisdictions. Instances may arise where a US citizen who is working in the US is granted restricted property and chooses to make the election to be taxed at grant but moves during the vesting period to a country that doesn’t recognize the election. In this situation, taxation will be applied based on the FMV at the day of vest.

Case study

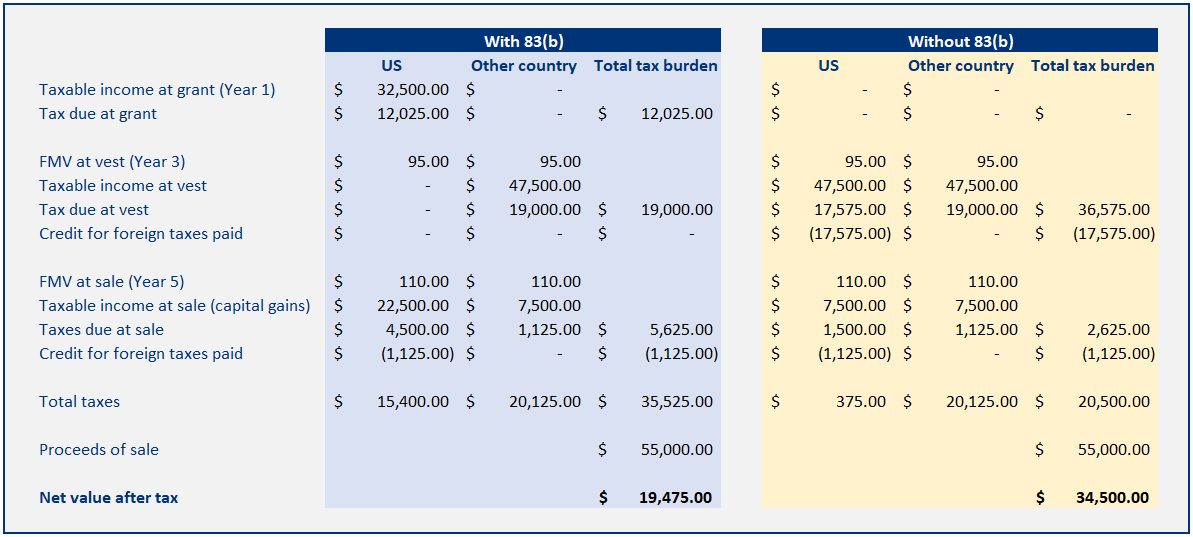

Let’s work through an example to illustrate just how detrimental a situation like this might be to the overall award value. Consider the case of a US individual who receives 500 shares of restricted stock that vest at the end of three years (all or nothing for simplicity’s sake), valued at $65 per share on the date of grant, and the individual makes an 83(b) election.

The taxpayer doesn’t pay anything for the shares. Halfway through the vesting period, the individual moves to a country with an ordinary income tax rate of 40% and capital gains tax rate of 15%. This country doesn’t recognize the 83(b) election and will tax the award when it vests while the individual is resident in the country.

Let’s also assume the US tax rates are 37% federal ordinary income rates and 20% capital gains tax rates.

To keep this simple, we will only focus on federal income tax.

Due to the mismatch in timing of taxation and limited ability to claim foreign tax credits, the employee is burdened with an additional $15,025 in global taxes when an 83(b) election has been made. Particularly in the cases of employer-sponsored moves, this additional burden may fall to the company to preserve the benefit and effectiveness of the equity compensation.

US Inbound

Situations may also arise where it may be advantageous for an individual who is inbound to the US and receives a grant of restricted stock to make an 83(b) election prior to arriving in the US. Assuming the individual is a nonresident alien for tax purposes at the point of grant, no taxable income would arise in the US by making the election, as any taxable value would be considered foreign sourced income (not taxable in the US for nonresident aliens). This would also serve to avoid ordinary income inclusions as the stock vests if the individual should relocate to the US over the vesting period.

Consideration would need to be made as to how the Home country would seek to tax the income, but in most cases where there is a compensatory income element, there may be a trailing tax obligation to the Home country to the extent services were provided in that jurisdiction during the vesting period.

Mechanically, it may be difficult (but not impossible) for a nonresident alien to make a section 83(b) election prior to US arrival. A section 83(b) election has several requirements that must be included on the election form—one of which is a US taxpayer identification number (TIN). It is rare for a nonresident alien to have a US social security number prior to arriving in the US. As the timeline of 30 days from date of grant to make the election is strictly enforced by the IRS, it is often recommended to file the 83(b) election prior to the 30 days lapsing, and then file an amended 83(b) election once a US TIN is received, either from the Social Security Administration (with visa) or by applying for an Individual Taxpayer Identification Number. It’s important to note that the IRS may initially reject the 83(b) election without a TIN, so it is extremely important to maintain accurate documentation and proof of filing the election.

Best practices for your mobile workforce

In addition to the careful consideration that must be paid by the taxpayer when deciding whether to make an 83(b) election, companies with mobile employees must consider whether an equity award will be adversely affected from a tax perspective by a relocation mid-stream during a vesting period.

When employees are granted equity, they generally have a perception of value of that award, and the company wants to align the interests of the employee with the interests of the shareholders to generate value within the organization. When value is significantly and unexpectedly chipped away by multi-jurisdictional taxation without relief, the employee’s perception of value decreases and the award could even be perceived as burdensome. Companies can mitigate these potential pitfalls by:

- Maintaining accurate payroll records and 83(b) documentation at the point of transfer.

- Proactively considering whether a potential employee transfer may be adversely affected if timing of taxation or no relief for double tax is available. Your mobility tax provider can assist with this analysis prior to a move.

- Communicating with your employees so they understand the relevant issues and how the company is prepared to assist in mitigating any adverse tax effects.

When considering whether to take the IRC Sect. 83(b) election, it is crucial to take into account various factors. This complex area requires a thorough review of probable scenarios so you can guarantee the most favorable outcome for both you and your employees. Schedule a complimentary consultation with one of our mobility tax experts to discuss your unique situation and develop a plan of action tailored to your company and employee needs.

See how our equity professionals and robust technology work together to ensure you meet your equity compliance needs:

The information provided in this article is for general informational purposes only and should not be construed as legal or financial advice. Always seek the advice of a qualified professional with any questions you may have regarding your situation.