In the current global business landscape, it has become increasingly common for companies to offer long-term incentives to their employees as a means of attracting, retaining, and rewarding them. However, while such incentives, including equity income, can be highly effective, they also come with inherent risks that require careful management and oversight.

One of the most significant challenges that companies face when offering long-term incentives is ensuring compliance with local tax and payroll obligations. This challenge is further compounded when employees are in different jurisdictions, as the rules and regulations governing tax and payroll can vary significantly from one location to another.

Failing to comply with these obligations can have serious legal and financial consequences for companies, as well as create talent management and duty of care challenges. Additionally, it can damage a company's reputation, which can have far-reaching implications for its long-term success.

To evaluate these risks, companies should first assess their mobile equity compliance exposure and then take the necessary actions to mitigate the risks and manage compliance accordingly. Depending on your company and equity department structure, it may be beneficial to build a case internally to illustrate your compliance exposure. For equity and payroll managers, staying compliant with the mobile equity reporting and withholding requirements can be a difficult task, especially when resources are limited.

In this article, we will discuss the crucial factors that companies should consider when assessing the compliance risk associated with their mobile equity program. By conducting a comprehensive evaluation of the factors and determining the resulting risk level, companies can then identify areas that require attention and take proactive measures to mitigate the risks.

The Factors of Compliance for a Mobile Equity Program

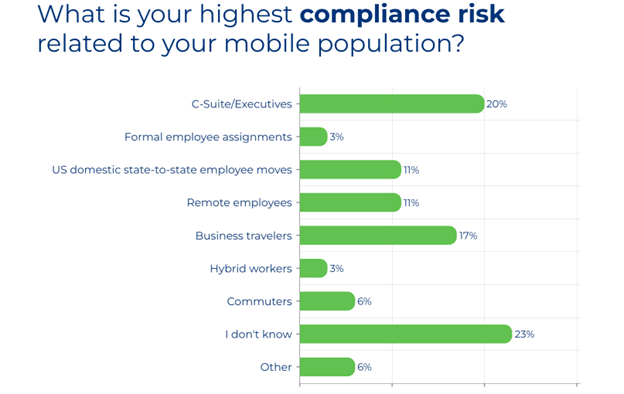

Based on our Future of Mobility survey, conducted in late 2022, 23% of companies don't know their highest compliance risk related to the provision of long-term incentive and equity compensation for their mobile employees. This highlights the need for companies to conduct a comprehensive assessment of their mobile equity compliance risk.

One way to measure the risk is through a mobile equity compliance risk self-assessment. A self-assessment is designed to help companies evaluate the highest likely risks related to their mobile population and evaluate the cost of complying with regulations. The GTN Mobile Equity Compliance Risk

Self-Assessment allows companies to consider several factors that go into identifying the compliance risk level, helps to define whether they are fully, partially, or not compliant domestically and internationally, and highlights areas where their program may need improvement.

Here are some of the factors you should consider when evaluating the risks of your mobile equity program:

Stock Price: Lower value stocks will carry a lower risk, where higher value stock will hold higher risk. If the fair market value (FMV) of your stock is volatile, this could also create a higher risk.

Consider: Has your stock price recently gone up? If so, there may be a greater risk exposure for non-compliance. Conversely, if the stock price has declined, it's a good time to review your processes.

Types of Awards: Offering just one type of award, such as stock options, restricted stock units (RSUs), or Employee Stock Purchase Plan (ESPP) will likely incur a lower risk. However, if you offer several award types, this can contribute to higher risk.

Consider: The more variety of awards offered, the more varying rules that may apply, and the more complexity to consider in achieving compliance.

Share Volumes: Providing a broad-based variable long-term incentive (LTI) plan, granting a significant number of shares, or issuing grants multiple times per year, could contribute to a higher risk level. Additionally, the dollar value of an award in relation to an employee’s overall compensation could contribute to a higher risk level.

Consider: Do you have a compensation plan that offers employees to elect all or a portion of their salary in stock? This could increase the volume and risk.

Employee Satisfaction: Do you have an employee communication plan in place to ensure your employees are aware of the company’s reporting and withholding obligations due to their cross-border movement? Do you provide guidance as to the impact of the required withholdings and their individual reporting and tax filing obligations? If your employees are not satisfied, are confused about the process, and/or don’t see the awards as a benefit to them, it could contribute to a higher risk level for your program.

Consider: If employees perceive that awards are not being properly managed, it can significantly raise the risk of employee turnover. Considering your company culture and the profile of plan participants, it is crucial to carefully determine the most suitable approach and frequency for communicating to your employees about awards.

Participant Global Locations: Awarding equity in multiple locations (either domestic or international), in high tax locations, or in jurisdictions with aggressive, complex, or strict regulations could contribute to a higher level of risk for your program. This is especially true if your employees have relocated to another country or have significant business travels to other countries that result in non-resident reporting obligations.

Consider: Any US Citizen or former US resident will likely have full or trailing tax liabilities for federal and state purposes.

Internal Capabilities: If your organization doesn’t have the appropriate technical expertise, bandwidth, and/or resources (either internal or external), it could contribute to a higher risk level for your program. Do you have the appropriate team to support you internally? Do you have external resources and vendors you can lean on? How much control do you have over payroll (domestic and international)?

Collaboration among your equity, HR/mobility, and payroll teams is essential to scaling your company's equity processes. To ensure that you stay compliant, you must have the technical expertise, bandwidth, and resources (either internal or external) to manage your equity program effectively.

Consider: Smaller or private companies are often supported by a one-person team. It is critical to engage resources to fill in for internal gaps in expertise.

Benchmarking and Policy: Consider what type of policies you have. Do you have a Remote First company where you prioritize remote work as a default mode of operation for your employees and have designed your processes, policies, and culture to support and empower remote employees? Do you have a complex compensation/rewards program? Does your HR team and/or systems track your employee locations?

Consider: With the ever common Remote First or Work Anywhere policy types, the number of employees who have crossed borders (state or international) is increasing and adding more risk.

The above factors serve as a solid foundation for assessing your company's compliance risk exposure for equity rewards. However, it's important to note that additional factors may also come into play. For instance, employee levels, permanent or temporary relocations, costs, and opportunities for reduction or automation, as well as consistency with other compensation treatments, can all have an impact on your company's overall risk exposure.

Assessing Risk Levels and Mitigating Potential Risks for Your Mobile Equity Program

After evaluating the factors mentioned above and completing the assessment, companies will be more aware of the level of risk they are exposed to. Each risk level requires a different approach to not only ensure compliance with relevant laws and regulations but also to ensure the seamless operation of your mobile equity program.

Low Risk: A low risk level suggests that the typical areas of risk are currently not problematic. However, as mentioned earlier, there may be additional factors that require careful consideration. While your risk level might be low, it's worth evaluating whether you are investing substantial time and financial resources to maintain compliance and if there are opportunities to automate certain processes, which can save time and minimize errors. Or you might be satisfied with your compliance in equity compensation but have yet to address other long-term incentives, such as annual bonuses.

Medium Risk: If a company has a medium risk level, it should seek help to identify the highest areas of exposure. Then create an implementation plan to reduce exposure and address compliance gaps. The plan should include measures to continue evaluating and managing these risks.

High Risk: For companies with a high risk level, it is essential to prioritize which groups are most critical to bring into compliance first. Defining what "compliance" will look like for the company (based on factors such as culture, risk tolerance, and industry) is also important. The company should determine the availability of internal resources and expertise versus what it may need to outsource. By doing so, the company can effectively manage its compliance risk and avoid potential legal and financial consequences.

Managing employee locations and tracking taxable events can be challenging in all cases. Moreover, tax laws are complex and constantly evolving, making it difficult to determine what, where, and when to report equity compensation. This process is time-consuming and requires significant effort from internal teams. Therefore, collaboration among equity, HR/mobility, and payroll teams is crucial to scaling a company's equity processes. To further streamline the process, it is essential to find a scalable and flexible technology that can automate activities, saving your team both time and effort.

Continuing to monitor compliance exposure and risk levels is an essential aspect of any mobile equity program. While offering long-term incentives can be a powerful tool for attracting and retaining top talent, it is essential for companies to approach this strategy with careful consideration. By taking a proactive approach to identifying and managing the risks associated with long-term incentives, companies can ensure that they are able to reap the benefits of this approach while minimizing the potential downsides.

At GTN, we understand the significance of mitigating risks and offer comprehensive risk assessment services for your mobile equity program. Our team of experts will work closely with you to identify potential areas of non-compliance and provide effective solutions to address them. Contact GTN today for a full risk assessment and ensure the smooth operation of your program.