As we approach the end of another year, businesses are navigating the intricate landscape of year-end payroll, with a particular emphasis on the unique challenges posed by the evolving nature of remote and mobile work. Over the past few years, we have witnessed a significant change in thinking about work dynamics, with remote and mobile employment becoming more prevalent than ever. Consequently, mobility and payroll professionals are faced with a set of challenges that demand a nuanced approach to ensure accuracy, compliance, and employee satisfaction.

To assist mobility and payroll teams as they finalize the US reporting and withholding requirements for their organization’s mobile and cross-border employees, let’s look at the top five payroll matters to consider for year end.

Remote work and multi-jurisdictional tax reporting

Over the last several years, strides have been made to solidify work from home, remote work, work from anywhere, and business travel policies that mitigate potential tax traps. However, many companies are still finding that the actual location of an employee’s “home” and the address on file for payroll reporting purposes are not always the same. In fact, in some cases, the employee may have been working in a different state or country, creating potentially new reporting and withholding requirements for the company.

As payroll requirements may differ based on where your employees are living and working, regardless of the reason, it's critical that you have a process in place to obtain and verify this data and to understand the payroll tax rules that apply.

- If your company currently doesn’t have payroll capabilities in all countries or states where you have employees (domestic or international), you may need to consider the administrative costs of setting up payroll capabilities in those locations.

- The payroll structure for remote workers can vary significantly based on many factors, including whether the change in work location for the employee is temporary in nature or permanent. It’s important to understand the specific employee scenario.

- If the company will pay for the travel costs associated with the employee traveling to their physical office of employment, will such payments be taxable? If so, who will pay the tax costs on the taxable travel benefits—the company or the employee?

If you have employees living in one state and working in another, there will likely be payroll complexities that must be addressed. In general, state withholding and reporting will be based on where the employee is physically working. However, there are exceptions to this rule:

- Reciprocity agreements: some states will agree with other states that the reporting and withholding will remain with the resident state. Proper payroll documentation is typically needed to support this treatment.

- Convenience of the employer rule: a limited number of states (Connecticut, Delaware, Nebraska, New Jersey, New York, and Pennsylvania) will continue to require withholding and reporting for workdays spent in a taxpayer’s “home office” in another state if the individual is assigned to an office in their state.

When dealing with international aspects, payroll intricacies may also surface even during short-term travel. The fundamental guideline is still that withholding and reporting typically hinge on the employee’s physical work location. However, exceptions to this principle may arise under specific circumstances:

- Income Tax Treaties: countries engaged in bilateral income tax treaties might offer relief under certain conditions. A thorough analysis of each treaty and travel pattern is necessary to determine whether the criteria are met for income exemption.

- Totalization Agreements: some countries may establish bilateral agreements for social security purposes. Depending on the duration of travel and the employing entity, an exemption from social security contributions may be applicable.

Careful consideration of the specifics is crucial to determine eligibility for these exemptions.

In the end, the company is responsible for appropriately tracking their employees, understanding the rules, and appropriately reporting and withholding for their employees. Tax, penalties, and interest can be assessed to the company if this reporting and withholding is not done correctly.

Withholding tax rate updates, deferral limitations, and other key changes

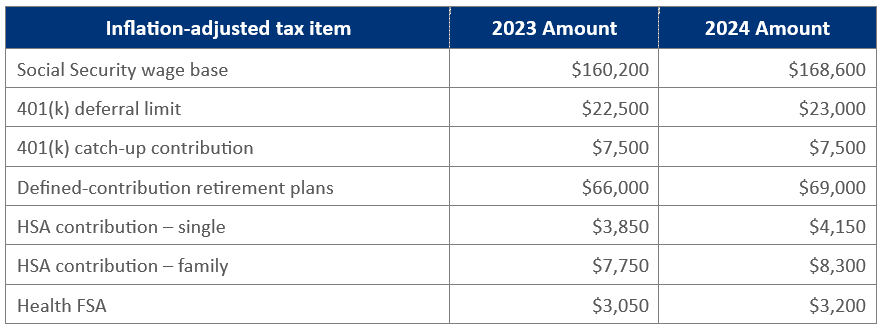

As we head into 2024, employers are gearing up for changes in employment tax withholding rates and updated deferral limitations for qualified plans. Staying informed of these adjustments is crucial for businesses to support compliance activities and allows employees to plan effectively for their financial future. Key payroll figures and updates include:

Another item to note includes an increase in the amount of income eligible for foreign earned income exclusion of $120,000 for 2024 (up from $112,000 in 2023).

State tax withholding changes and rates can vary widely, affecting both employers and employees. Employers should stay informed about any updates to state tax withholding regulations, as changes can affect payroll processing and compliance. Adjustments in state tax rates may occur due to legislative decisions, economic factors, or shifts in the state's fiscal policies. Regularly reviewing state tax withholding tables and guidelines helps ensure accurate payroll calculations, timely filings, and compliance with state tax laws.

Taxation of long-term incentive awards

Navigating the cross-border importing or exporting of a long-term incentive plan is a task more complex than it may initially seem. The movement of employees who participate in long-term bonus, deferred compensation, or equity plans introduce substantial compliance risks, especially when vesting occurs over multiple years across different US states or international jurisdictions.

This complexity leads to potential lingering tax obligations, contingent upon where services were rendered during the vesting period. Consequently, companies and employees might find themselves liable for taxes on long-term incentive compensation long after they have left a particular location. To address these challenges, companies must not only be aware of compliance obligations but also maintain a comprehensive record of an employee's travel throughout the vesting period to accurately account for global tax considerations.

Furthermore, if employees face additional taxes due to working in multiple jurisdictions, it can contribute to a perceived devaluation of the awards within the mobile employee population when tax issues are not proactively addressed and communicated. In many instances, what qualifies as a “qualified” plan in one location, such as US Incentive Stock Options (ISO) or Employee Stock Purchase Plans (ESPP), may not enjoy the same status in another jurisdiction.

This divergence leaves employers grappling with the decision to adopt specific sub-plans or find alternative methods to equitably compensate employees and level the award playing field across the entire employee population. Effectively mitigating these tax issues becomes imperative to uphold the intrinsic value of the awards as a meaningful employee benefit.

See how our equity professionals and robust technology work together to ensure you meet your equity compliance needs:

Use of fiscal year cut-off for compensation reporting purposes

The compensation accumulation process for cross-border payroll purposes can be time consuming and complex. To provide enough time to meet payroll reporting deadlines, many companies have used fiscal-year reporting for employee benefits (e.g., reporting on a November 1 – October 31 basis on Form W-2, rather than on a calendar year payment basis). Although IRS rules allow for fiscal-year reporting, this rule is often misapplied in the context of compensation reporting for mobile employees.

The IRS allows fiscal-year reporting for certain non-cash benefits provided during the last two months of the calendar year, or any shorter period within the last two months. This rule provides companies with the time necessary to compute the income inclusion for these non-cash benefits. For example, assuming an October 31, 2023, cutoff, a company would report the imputed income relating to the twelve-month period ending October 31, 2023, in the employee’s 2023 Form W-2. The company reports the imputed amount relating to November and December 2023 in the 2024 Form W-2.

As noted, this rule can only apply to specified non-cash benefits. Common benefits for mobile employees including housing and cost-of-living allowances and reimbursement for home leave expenses are cash benefits and are not eligible for this type of fiscal-year reporting, even if the benefit is not reimbursed or paid directly to the employee.

One possible solution is to implement a fiscal year cut-off for reimbursement of cash and non-cash benefits. For example, a company could use a December 1 – November 30 reporting period for benefits, if the company had a policy for suspending expense reimbursements in December. If implemented, this method should continue in future years.

Taxable fringe benefits, gross-ups, and avoiding Form W-2c

Employers often face challenges in accurately compiling global income and applying tax gross-ups by year end. Special wage payments, not processed through payroll but constituting taxable compensation, demand meticulous data collection, income imputation, and withholding. Such payments encompass various forms, including housing allowances, moving expense reimbursements, club memberships, educational assistance exceeding plan limits, home sale assistance, auto allowances, forgiven or below-market rate employee loans, and more.

It is imperative for employers to comprehensively report all income and ensure accurate tax remittances, either withheld or grossed-up, to prevent underwithholding issues, penalties, interest, or the need for corrective actions such as filing a Form W-2c.

In the past, employers would often provide a tax gross-up after year end as an “administrative error” and issue a corrected Form W-2 (Form W-2c, Corrected Wage and Tax Statement) to include both the taxable wage and withholding increases for the gross-up. IRS regulations and guidance seemed to support this position. However, the IRS clarified their position in 2017 on the definition of an “administrative error” and indicated that the definition does not include prior-year adjustments to federal income tax withholding paid by the employer (a gross-up).

The IRS guidance also eliminated the possibility of correcting prior-year federal tax overpayments (gross-downs) through use of Form 941-X. Employees repaying amounts to their employers must now use Internal Revenue Code Section 1341 claim-of-right doctrine to reduce the income taxes owed on repayments. Employers may adjust Forms 940/941 for prior years’ FICA taxes only to recoup overpaid Social Security and Medicare taxes.

As can be seen from the above year-end payroll considerations, it is critical to stay up-to-date on current tax developments.

BONUS TIP! Reflect and strategize to set the stage for future success

As the year draws to a close, it's crucial for mobility leaders to pause and engage in strategic reflection. The year-end period often coincides with a flurry of activities, and the holidays can be a joyous but distracting time. However, taking a moment to disengage from the day-to-day operations and reflect on the broader scope of the year is essential for setting the stage for future success.

Reflecting on the past year provides an opportunity to assess achievements, challenges, and areas for improvement. It's a chance to celebrate successes, no matter how small, and acknowledge the lessons learned from setbacks. This introspection is the foundation for informed decision-making in the coming year.

Mobility leaders can find patterns, trends, and insights that may inspire strategic adjustments and improvements. Often this reflection is conducted in tandem with service providers who can help the company assess the total program spend, offer suggestions for risk mitigation, and propose opportunities for efficiency.

While the year-end period may be marked by a whirlwind of activity, taking the time to reflect and be strategic is an investment in the future of the business. By celebrating accomplishments, learning from experiences, and planning strategically, mobility teams can navigate the new year with purpose and resilience, ensuring sustained growth and success.

To explore how our services can help streamline your payroll reporting and ensure tax compliance, we invite you to schedule a consultation with our experts. Let's work together to make the year-end transition seamless and efficient.